United states treasury bond rate

By law, income to the trust funds must be invested, on a daily basis, in securities guaranteed as to both principal and interest by the Federal government. All securities held by the trust funds are "special issues" of the United States Treasury. Such securities are available only to the trust funds.

In the past, the trust funds have held marketable Treasury securities, which are available to the general public. Unlike marketable securities, special issues can be redeemed at any time at face value. Marketable securities are subject to the forces of the open market and may suffer a loss, or enjoy a gain, if sold before maturity. Investment in special issues gives the trust funds the same flexibility as holding cash.

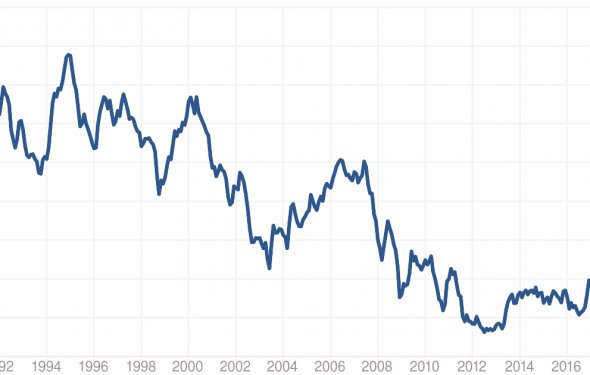

The numeric average of the 12 monthly interest rates for 2016 was 1.813 percent. The annual effective interest rate (the average rate of return on all investments over a one-year period) for the OASI and DI Trust Funds, combined, was 3.154 percent in 2016. This higher effective rate resulted because the funds hold special-issue bonds acquired in past years when interest rates were higher.

Tax income is deposited on a daily basis and is invested in "special-issue" securities. The cash exchanged for the securities goes into the general fund of the Treasury and is indistinguishable from other cash in the general fund.

Money to cover expenditures (mainly benefit payments) from the trust funds comes from the redemption or sale of securities held by the trust funds. When "special-issue" securities are redeemed, interest is paid. In fact, the principal amount of special issues redeemed, plus the corresponding interest, is just enough to cover an expenditure.

Money flowing into the trust funds is invested in U. S. Government securities. Because the government spends this borrowed cash, some people see the trust fund assets as an accumulation of securities that the government will be unable to make good on in the future. Without legislation to restore long-range solvency of the trust funds, redemption of long-term securities prior to maturity would be necessary.

Far from being "worthless IOUs, " the investments held by the trust funds are backed by the full faith and credit of the U. S. Government. The government has always repaid Social Security, with interest. The special-issue securities are, therefore, just as safe as U.S. Savings Bonds or other financial instruments of the Federal government.

Many options are being considered to restore long-range trust fund solvency. These options are being considered now, well in advance of the year the funds are likely to be exhausted. It is thus likely that legislation will be enacted to restore long-term solvency, making it unlikely that the trust funds' securities will need to be redeemed on a large scale prior to maturity.